Wealth creation or creation of bubbles?

Intuitively, changes in company shares should follow changes in company profits. The more a company grows its profits, the greater the creation of shareholder value should be.

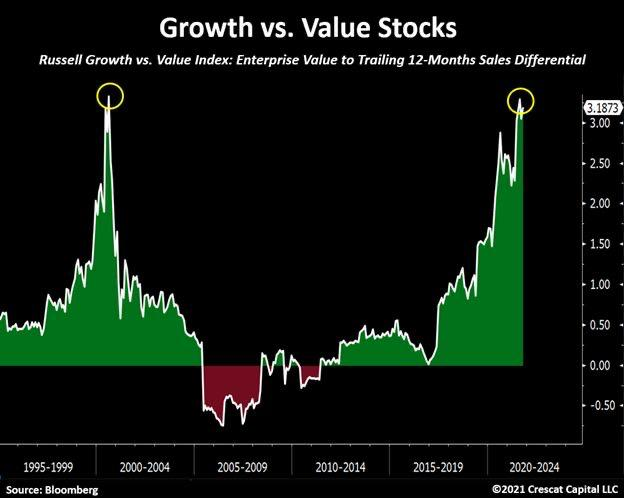

However, interest rates and injections of liquidity by central banks have distorted this relationship between earnings and stock price development.

Here are some examples of well-known values.

Change in earnings over 5 years

Roche 44%

Nestlé 7%

Givaudan 22%

Lindt 6%

Sika 63%

ABB 89%

Change in share price over 5 years

Roche 50%

Nestlé 23%

Givaudan 90%

Lindt 56%

Sika 118%

ABB 18%

We can see that while the shares of Roche and Nestlé follow the evolution of earnings relatively closely, the shares of Givaudan, Lindt, and Sika have become detached from reality. Conversely, ABB shares have risen only 18% in 5 years while the company's profits have grown 89%.

You do not have to be a finance specialist to see where the value creation is and where the financial bubble is ...

Do not hesitate to contact us !

Contact us