“Growth” stocks versus "value" securities: time to take a deeper review

Investors often distinguish between high growth companies ("growth stocks") and defensive companies ("value shares"). The purpose of this distinction is to take into account the expected future growth in the frame of the valuation of the share price. Indeed, this is the only realistic way to compare a growing company with a company whose business is at a more mature stage.

Depending on the market conditions, and depending on their risk appetite, investors will rather seek to take additional risk for the potential for future gains with growth stocks, or on the contrary, look to take refuge in more defensive stocks that have a lower potential of declines in case of market shocks.

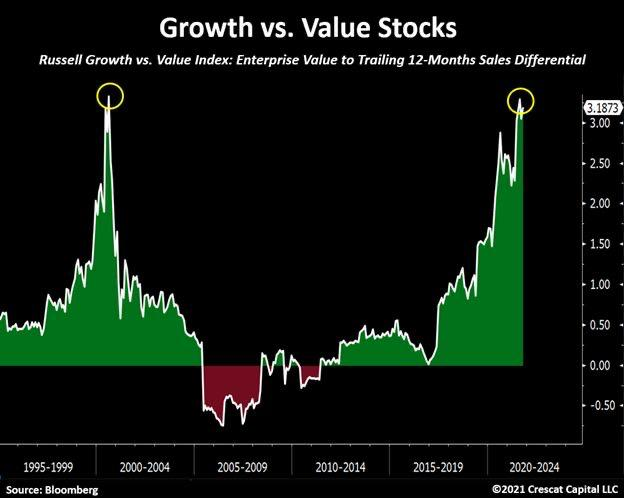

Currently, as illustrated in the chart above, investors are much more risk-taking, and this can be seen with a measure of how expensive growth stocks are compared to defensive stocks.

In fact, this chart shows that growth stocks have never been as expensive as they are today, compared to defensive stocks, since the period 1999 to 2000 that preceded the Nasdaq crash in March 2000. For the record, the dot-com bubble preceded an almost 80% drop in the Nasdaq index with many companies going bankrupt. Another interesting fact is that ten years after the dot-com crash, in 2009, the Nasdaq index was at the same level as during the low points of March 2003. Investors thus lost ten years on the stock market while the technology sector continued to grow.

So, at the end of 2021, we must seriously ask ourselves whether a trend reversal may take place, not because the high-tech sector is going to disappear, but because investors are potentially heavily overpaying for these shares.

Warren Buffet, through his company Berkshire Hathaway, has been a net seller of shares in recent months. Liquidity in his company has continued to climb to a record USD 494bn due to the lack of buying opportunities. If the Sage of Omaha is being cautious, should you be too?

Do not hesitate to contact us !

Contact us