Speculative advice

OUTLOOK FOR THE FINANCIAL MARKET AND OTHER IMPORTANT TOPICS FOR INVESTORS

Dear Reader,

Each new year is an opportunity to perform a new assessment of the world's economic and political situation, to evaluate what could stay the same and what could change, and try to identify risks and opportunities in the financial markets

As we try to go through a thorough and fact-based analysis, it is important to remember that the human mind has several well-known cognitive biases. One of these biases is that the human mind tends to extrapolate things, and this often leads to missing changes in trends.

For example, one can remember that at the beginning of 2023, most investors were negative on technology shares, but as we know, technology shares ended by massively outperforming the markets. In October 2023, investors were convinced interest rates would continue to go higher. Instead, government bond yields saw a massive decline.

In this this research note, we will discuss a variety of issues and topics which will shape the financial markets in 2024.

We remain at your disposal for any questions and look forward to any comments or feedback from our distinguished Readers.

SUSSLAND & CO LTD.

1. SOME OF THE TRENDS SEEN IN THE SECOND HALF OF 2023 WILL CONTINUE IN 2024

- Positive trends:

o Declining inflation (although at a smaller pace than in the second half of 2023);

o High level of corporate profitability and balance sheet deleveraging;

o Low unemployment and resilient consumer spending in the United States and Europe;

- Negative trends:

o Weak Chinese economic growth;

o Geopolitical risks (Ukraine, Middle East, Taiwan);

o Political risks (US congress, US presidential elections).

As these trends are not new, but are simply persistent, we do not expect them to change the positive trend seen in the financial markets since the end of 2023.

2. DUE TO DECLINING INTEREST RATES, MONEY FLOWS SHOULD CHANGE IN 2024

Indeed, the higher interest rates in 2022 and 2023 had the consequence of removing liquidity from financial assets as investors favored cash and very short-term liquidity instruments.

With central banks due to cut interest rates in 2024, we expect significant money outflows from cash and quasi cash instruments back to the financial assets and real estate.

In the United States, assets of money market funds increased by USD 1.3 trillion in 2023 to a record USD 6 trillion. In the US alone, customer deposits exceed USD 17 trillion at the end of 2023. We are therefore looking at a situation where world liquidity could be in excess of USD 30 trillion. Even if only 5% of this amount moved back to financial assets, i.e. USD 1’500bn, the impact on the prices of financial assets would be significant.

While there are many other factors that exist, ultimately interest rates drive money flows and money flows drive asset prices.

3. VALUATIONS OF EQUITIES APPEAR IN SOME CASES “FAIRLY VALUED”, BUT WE DO NOT SEE SIGNS OF OVERVALUATION.

Based on current expected earnings for 2024, the S&P 500 is trading with a P/E of 19x, the Nasdaq Composite with a P/E of 29x, the Nikkei with a P/E of 21x. European shares trade with P/E ratios of about 11x, while Chinese equities trade at 8x earnings.

These valuation multiples could actually expand in 2024 as interest rates do down leading financial assets to become more attractive.

4. TECHNOLOGY WON’T BE THE OUTPERFORMER IT WAS IN 2023, BUT SHOULD CONTINUE TO PERFORM WELL IN 2024

The positive trends for technology will continue in 2024 as the world continues to be driven by cloud computing, artificial intelligence, energy efficiency (which includes composite materials, battery technology, etc), e-commerce and e-learning, virtual and augmented reality, etc.

Nevertheless, the valuations of the large technology mega caps are no longer those of early 2023 and investors should consider other tech stocks too.

5. ENERGY AND HEALTHCARE ARE TOO CHEAP TO IGNORE.

Energy prices are too low, and we expect supply to be restrained as at current levels, oil producing companies and private companies have no incentive to increase production. To the contrary, we expect OPEC to keep its oil production unchanged and private companies to continue favoring dividend payouts and share buybacks over production increases. This will happen as global demand for oil should accelerate in 2024 by +2 million barrels per day to 103.5mio barrels a day according to Wood Mackenzie.

Energy stocks could generate total returns (including dividends) >20% in 2024, and more in the case of severe geopolitical risks.

Healthcare stocks have been among the worst performers in 2023, if one sets aside Eli Lilly and Novo Nordisk.

We believe that as the economic growth slows down in 2024, investors will return to the healthcare sector which offers a lot of value. We also believe that artificial intelligence will be a key driver to reduce R&D costs and increase the discovery of new drugs. One should not forget that healthcare spending should continue to increase by ~8% in 2024 due to aging populations and worsening lifestyle trends.

6. THE US DOLLAR SHOULD STRENGTHEN

The US dollar appears undervalued to other currencies based on the real interest rates (ie the interest after inflation).

The average forecasts of central bank rates and inflation, and real interest rates are shown in the table below.

|

Market forecast for 31.12.24 |

USD |

EUR |

GBP |

CHF |

JPY |

|

Central bank rates |

4.30% |

3.50% |

4.50% |

1.25% |

0.00% |

|

Inflation

|

2.40% |

2.30% |

3.00% |

1.50% |

2.30% |

|

Real interest rates |

+1.90% |

+1.20% |

+1.50% |

-0.25% |

-2.30% |

In addition, we believe that the political situation in the United States will remain gridlocked with no single party controlling the US congress, therefore containing future spending.

Many analysts remain fundamentally negative on the US dollar citing high levels of debt. However, like for companies, what matters more than the absolute level of debt is the relative level of debt to cash flow and the level of debt to equity.

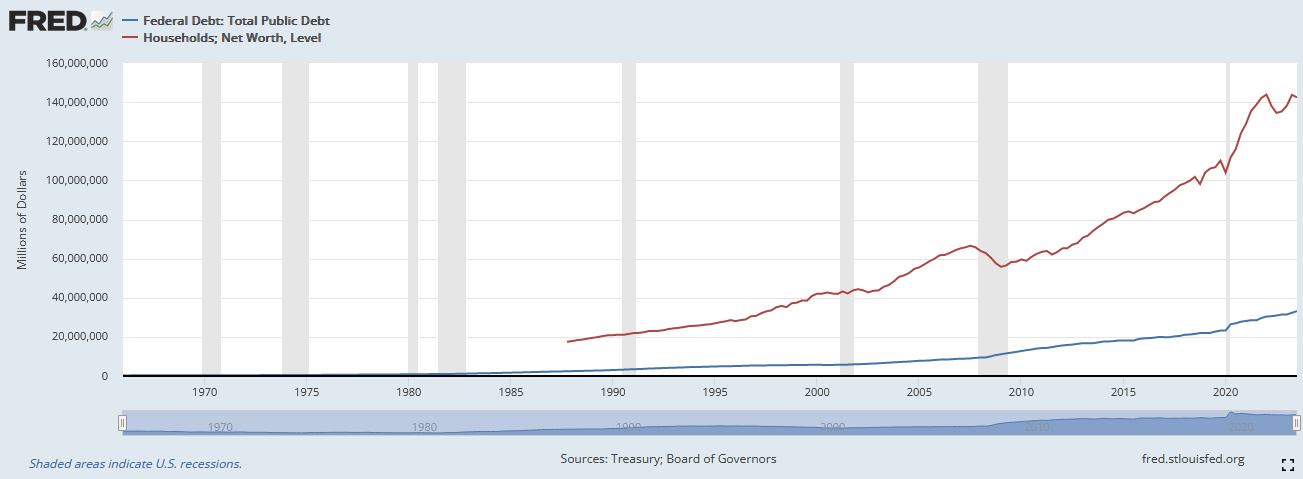

Chart 6.1.: US Household net worth and US Federal debt (source: St-Louis FED)

The chart above shows the US federal debt (blue line/bottom line) and the US Household net worth (red line/top line).

We can notice that:

a) US Household net worth is much bigger than US Federal debt (USD 142 trillion in household wealth vs US Federal debt at USD 33 trillion);

b) US Household net worth is increasing at rates in-line with US debt. Since 2010 the annual growth rate of the US Household wealth is +6.84% pa vs. +6.91% for US Debt;

c) The difference (or spread) in between the US Household net worth and the US Federal debt reached USD 110 trillion as of 30.09.2023 which is near a record high.

In other words, the US debt is increasing, but the wealth of US consumers is increasing at a faster pace than the increase in debt. From 12.31.2019, before the pandemic, up to 30.09.2023, US Debt increased by USD 10 trillion, but US Household net worth increased by USD 32 trillion!

The debt levels of the US are therefore not worrisome when compared to the creation of wealth by US consumers!

Finally, as companies continue to assess the risks on their supply chains, with the experience of the US trade wars of 2018 and the pandemic in 2020, we expect to see an acceleration of industrial-re-shoring in the United States, ie companies investing more in the United States to increase production and warehousing capabilities. This means more investing in the United States, and therefore an increase in demand for US dollars.

7. CENTRAL BANKS WILL CUT RATES IN 2024, BUT CENTRAL BANKERS WILL WARN MARKETS NOT TO GET COMPLACENT

Central banks do not want investors to become complacent about inflation and will continue to say that their future course of action depends exclusively on the trajectory of inflation and that they will not rule out maintaining interest rates at current levels for longer if necessary or even increasing interest rates.

Therefore investors should not overreact to negative comments by individual central bankers, some of which are more focused on inflation than on growth.

The reality is that as the economic growth is set to decelerate in 2024, inflation pressures will drop. It is only a question of how fast and how low.

We have mentioned in the past the two big disinflationary/deflationary trends that are the ageing of the population and technology. These trends remain strong.

In addition, there is a new global deflationary trend that has emerged since the second half of 2023: China.

Indeed, China is in a recession and unsurprisingly, China is now seeing deflation, i.e. lower prices, both for consumers and companies. The latest Chinese consumer price index was -0.30% for the last twelve months ended december 2023, while the producers price index was -2.70% for that same period.

In other words, China is now starting to export deflation as the cost of production in China is going down. In terms of currency. The Chinese yuan dropped by 3% over the past year and is close to historical lows against the US dollar which means that buying Chinese goods and services is much cheaper than in the past.

© SUSSLAND 2024. The Jet d’Eau symbol and SUSSLAND are registered trademarks of SUSSLAND. All rights reserved.

OUTLOOK FOR THE FINANCIAL MARKET AND OTHER IMPORTANT TOPICS FOR INVESTORS

A turning point in the markets

Inflation, high interest rates, risks of slower consumer spending, possibility of a US hard economic landing and increased geopolitical tensions are just some of the many issues that investors must currently deal with.

We have seen new worries come up in 2023 such as the prospect of a US default on its debt, concerns over the next US presidential election or the dysfunctional American congress that leads to uncertainty in the long-term funding of the budget of the United States .

We have witnessed many crises over the past years: pandemic, wars, political tensions, etc. From such experiences, investors know that the “market noise” can be quite loud, but that significant changes in prices do not necessarily reflect changes in the fundamental value of assets.

Investors have seen that market sentiment and paradigms change fast. We can remember that at the end of 2022, many analysts were negative on technology stocks, including Apple, Tesla, Amazon, Meta, Nvidia, Netflix orMicrosoft that have significantly outperformed indices in 2023.

We believe that corporations are telling the correct message when they are warning about slower consumer spending and an overall weaker economy. This should lead long-term interest rates to start to drop.

Considering that equity prices are more sensitive to interest rates than to earnings, we believe that the financial markets are now at a turning point, as in our viewlong-term bond yields have reached their peak.

In this this research note, we will discuss a variety of issues including inflation and interest rates. We will also quantify the upside on equity markets over the next 12 to 18 months.

We remain at your disposal for any questions and look forward to any comments or feedback from our distinguished Readers.

SUSSLAND & CO LTD.

1. Executive summary

- The key driver of the financial markets is the evolution of interest rates in the United States. 10-year US treasury yields are close to 5.00%. The last time that they were at these levels was in 2006 and 2007, before the financial crisis of 2008;

- Many US and European corporations are warning investors about a more difficult economic environment, highlighting weaker consumer spending;

- Despite these warnings from the private sector, central banks, including the US Fed, continue to declare that their principal worry is inflation;

- Investors are therefore worried that central banks are focusing on back-looking data rather than forward looking data. This could lead central banks to keep short-term interest rates at higher levels than necessary and for longer than necessary. Analysts fear that this could trigger a “hard” economic landing, or worse, a recession;

- The inflation that occurred after the pandemic was purely accidental. It would not have happened if there had not been multiple lockdowns in 2020 and 2021. The long-term trend for most of the world remains disinflation;

- Excess savings accumulated during the pandemic enabled consumer spending to remain strong in 2021 and 2022 despite high levels of inflation. However, the high level of interest rates is now clearly taking a toll on the ability of consumers to spend;

- Since consumers have a budget that is not extendable (wages have not increased as much as inflation or rents), these higher costs will require individuals to save on other areas. Over the past weeks we have seen companies warn over consumer weakness in many sectors including airline travel, toys, orthodontic products, cars, furniture, and restaurants.

- Analysts are therefore revising their revenues and earnings forecasts lower. Economists are also revising lower GDP growth in 2024;

- The natural consequence of lower growth, or possibly recession, is that long-term bond yields will drop. This drop will occur many months before central banks start to cut short-term interest rates in mid-2024:

- In our view, current stock prices fully price in lower expectations for 2024;

- Stock prices are much more sensitive to changes in interest rates than to changes in earnings. Historically, a 120bps drop in rates leads to an increase of the Nasdaq of 25%;

- We believe that the stock market has bottomed, and offers significant upside;

- Politics and geopolitics impact the markets in the short-term, but not in the long-term. Neither US politics, the war in Ukraine, the war in Israel, or China-US relations should affect the markets in the long run;

- With declining interest rates, bonds, equities, and gold should all see price increases;

- Our preferred equity sectors are technology, financials, consumer staples, and energy. In renewable energy, only solar energy appears to offer viable economics;

- In bonds, we advise investors to increase durations;

- The dollar will remain the reserve currency of the world and should appreciate due to high positive real interest rates. Talks about de-dollarization are unrealistic.

2. The current situation in the economy and the markets

2.1. Where are we coming from?

At the end of 2022, investor sentiment was extremely negative. In the United States, inflation was high, and analysts were expecting inflation to remain high and feared that interest rate increases by the US Fed would lead to an economic slowdown.

Contrary to expectations, the financial markets improved significantly over the first semester of 2023. This positive evolution followed the decline in inflation in the United States, which dropped from 6.5% in december 2022 to 3.0% in june 2023. Investors became more optimistic and started to expect the US central bank to become less restrictive.

However, since august 2023, the financial markets have been in a correction mode.

Several reasons can explain this.

First, at the end of july, many stocks became overbought, especially in technology where many stocks benefited from the excitement related to the opportunities arising from artificial intelligence (hereafter “AI”).

Second, the goodearnings for the second quarter of 2023 had been anticipated and were reflected in the share prices. There was not enough « new » news from companies to push stock prices higher.

Third, inflation in the United States started again to climb for reasons that will be discussed further, in section 3. The communication from the US Federal Reserve became increasingly hawkish (i.e., negative). Jerome Powell and other members of the Fed repeatedly indicatedthat inflation was not under control and that higher interest rates were necessary to bring inflation back below their long-term target of 2.00%.

It should be added that a) the US Fed did not change itsinflation target and b) the US Fed has stated that it wants to reach its inflation target as fast as possible. The financial markets, which had been previously expecting that the first interest cuts would occur in early 2024, now onlyexpect the first interest rate cuts in july 2024.

2.2. Where are we now?

While at the beginning of the year, the economic base case was the one of a “soft landing”, i.e., a gradual slowdown in the economy, economists are now more and more worried about a “harder” economic landing.

Indeed, high interest rates are posing an increasing risk for economic growth.